A material item may be Managed or Unmanaged.

Want to view this guide all at once?

Download PDFManaged materials

Unmanaged materials

Inventory Accounting for Managed Materials

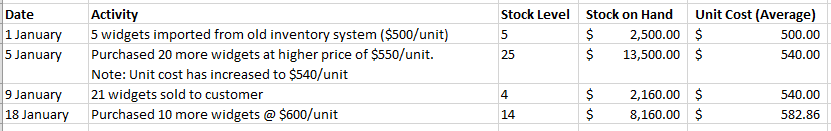

The unit cost of managed materials is calculated using the perpetual average inventory accounting method, which means that the unit cost reflects the cost of buying the current stock (including freight and other landing costs), even if it was purchased over different dates at different prices.

Example of how this might work out in practice:

Xero Accounts and Journaling for Managed Materials

Xero accounts should be setup as described below. Once setup, these accounts need to be selected in TidyEnterprise under GLOBAL SETTINGS > ACCOUNTING.

Stock on Hand

This should be set up as a Current Asset account in Xero, for example:

The Xero Inventory account cannot be used - it is locked and for Xero internal use only.

Cost of Goods sold

This Should be a Direct Costs account in Xero, for example:

Stock adjustments

Adjustment include breakages, stocktaking adjustments, etc. This should be a Direct Costs account in Xero, for example:

It may be a separate stock adjustment account, or the COGS account, depending on business and accounting preferences.

Sales

Managed materials- When a Sale is completed, the lines on the invoice in Xero are coded to the nominated default Sales account (e.g. 200 Sales) or a specific Sales account nominated in the items Material Category in TidyEnterprise. Tidy creates a special zero-total bill in Xero to credit the nominated Stock on Hand account and debit the Cost of Goods Sold account.

Unmanaged materials- Same as managed materials, but no bill is created in Xero.

Purchasing Stock

Managed materials- When stock on a purchase order is received, the value is debited to the nominated Stock on Hand account in Xero.

Unmanaged materials- are credited to the Cost of Goods Sold account in Xero.

Adjustments

Managed materials- will create a zero-value bill in Xero to debit / credit Stock on Hand and credit/debit Adjustment accounts. The effect on these accounts will depend on the nature of the adjustment, and whether it has a positive or negative effect on stock levels.

Unmanaged materials- Not applicable. Adjustments are made simply by modifying the stock level, but the modification is not explicitly tracked or accounted for.

Want to learn more? Check out these related guides